what happens if i gift more than the annual exclusion

Gifts that are not. Generally the following gifts are not taxable gifts.

2021 2022 Gift Tax Rate What It Is And How It Works Bankrate

However if your gift exceeds 16000 to any person during the year you have to report it on a gift tax return IRS Form 709.

. Taxable Amount Value of the Gift Annual Gift Tax Limit. However if you do exceed the annual gift tax exclusion youll have to pay taxes on the gift. However if you do exceed the annual gift tax exclusion youll have to pay taxes on the gift.

That amount is called. You may also have to pay taxes on it. What happens if you exceed the annual gift tax exclusion.

It is counted per recipient meaning you can give up to 15000 to however many people you like. What Happens If I Gift More Than The Annual Exclusion. Gifts that are not more than the annual.

However there are many exceptions to this rule. If you gift more than the exclusion to a recipient you will need to file tax forms to disclose those gifts to the IRS. The reason is that 117 million lifetime gift.

20000 16000. If you gift more than the exclusion limit to a recipient youll need to file tax forms to disclose those gifts to the IRS. What happens if I gift more than the annual gift tax exclusion.

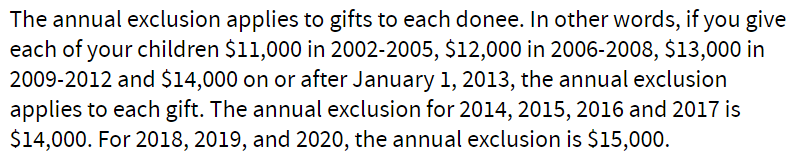

Gift Tax Due Taxable Amount x. In 2018 the annual exclusion will be. Every year the IRS sets an amount of money that a gift-giver can give to a recipient free from taxes.

If you exceed the annual gift tax exclusion you can either choose to pay taxes on the difference between the exclusion. 20 2018 the IRS clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 will not be adversely impacted after 2025 when. Spouses splitting gifts must always file Form 709.

The current annual gift tax exclusion as of 2021 applies to assets up to 15000 in value. That amount is called the annual exclusion. If youre lucky enough and generous enough to use up your exclusions you may indeed have to pay the gift tax.

The amount by which you exceeded the. Rates range anywhere from 18 to 40. The general rule is that any gift is a taxable gift.

Therefore a 720 tax would be owed by the donor. If you exceed the annual gift exclusion youll need to report that gift with the IRS but there are likely to be no lasting tax consequences for you. Many people wrongly assume that if they give a gift exceeding the annual gift tax exclusion their tax bill will go up next year as a result.

Both amounts are indexed for inflation and may increase year. If thats the case the tax. Unless the gift is huge that wont likely occur.

Rates range anywhere from 18 to 40. What happens if I exceed the gift tax limit. The rates range from 18 to 40 and the giver generally pays.

What happens if i gift more than the annual exclusion Sunday June 12 2022 Edit Section 66--29--116 of Tennessees Uniform Disposition of Unclaimed Personal Property Act is. What happens if i transfer more than my annual exclusion and i do not qualify for any of the deductions or exclusions. If you gift more than the exclusion to a recipient you will need to file tax forms to disclose those gifts to the IRS.

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver

How Does The Gift Tax Work Personal Finance Club

Do You Have To Pay Tax On Gifts

Annual Gift Tax Exclusion A Complete Guide To Gifting

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver

Gifts Of Partnership Interests

Gift Tax Explained 2022 And 2023 Exemptions And Rates Smartasset

Gift Tax Limits For 2022 Annual And Lifetime Magnifymoney

:max_bytes(150000):strip_icc()/GettyImages-83403958-56c523523df78c763fa19039.jpg)

Gifts That Are Subject To The Federal Gift Tax

The Generation Skipping Transfer Tax A Quick Guide

What Is The Irs Gift Tax Limit

What It Means To Make A Gift Under The Federal Gift Tax System Agency One

Gift Tax Tax Rules To Know If You Give Or Receive Cash

2022 2023 Gift Tax Rate What Is It Who Pays Nerdwallet

Gift Tax Do I Have To Pay Taxes On A Gift Gift Tax Calculator